You shall be doing these calculations on IRS Form 8829 and together with this kind on your business tax return. The space should be used as your principal place of work or for particular business functions, like assembly purchasers or doing enterprise paperwork. If you’ve more than one business location, contemplate the period of time spent at every location and the relative significance of activities at each location.

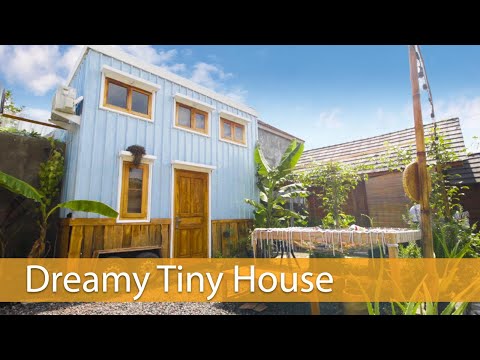

Thanks to gentle colors, good storage ideas, and intentional dividing of “zones,” Kristy Marhin has carried out an amazing job of making a cozy residence in simply 230 square toes. Here is a sensible structure for a really small house workplace that options lots of storage. Make your own home workplace part of a storage wall for a more built-in look. A foldable storage unit may turn into a completely functional residence office when needed. Taking advantage of every bit of house mean you can tuck a small residence workplace under any staircase. A small dormer office with built-in cupboards is certainly a way to make use of every once of area.

Get tips for arranging living room furniture in a method that creates a snug and welcoming environment and makes probably the most of your area. We settle for all space related occasions in our calendar and all it takes is about 5 minutes for your to fill out the web event form. A fairly hamper can double as organization and decor, if carried out proper.

Advertising, salaries, and supplies bills aren’t deductible as “enterprise use of the home,” but they might be deductible elsewhere in your tax return. You cannot deduct residence bills that are not related to your business. For example, should you put in a swimming pool or a brand new deck on another a part of the home, you can’t deduct these prices as business expenses.

Indirect bills are those paid for working your home which may be deducted based on the proportion of the house used for business (see “Calculating Your Home Office Space Deduction”). Direct expenses are those used just for the enterprise section of your own home. An example could be paint, wallpaper, and carpeting used solely in that area. You can deduct these expenses at 100% because they are solely associated to your corporation. The subsequent step is to determine the kinds of home based business expenses you can deduct. In addition to your different enterprise bills, the IRS allows you to deduct and indirect expenses which are related to the “enterprise use of your own home.” To use this method, you may first must calculate the house in your house used for enterprise .