Basically, the Fed does not instantly set mortgage rates, however its insurance policies can influence the financial markets and movers that do. When it comes time to compare loans, it’s all the time important to have a clear picture of all related prices.

It consists of the interest rate, closing costs, and different fees corresponding to private mortgage insurance . Be sure to check all of those fees and prices to get an image of which provides you one of the best overall deal. Bankrate’s price tables are updated throughout the day and include up-to-date interest rates, APRs, upfront fees and month-to-month payments for the quantity you select. Changing the terms or length of a loan can have a major impact on the loan’s comparability price. With this in thoughts, it pays to generate your personal comparability rate for your anticipated borrowing quantity, with the lenders you are contemplating. Many lenders cost a month-to-month account payment for his or her mortgage accounts. Some may also charge an establishment payment, valuation charge, mortgage documentation payment and settlement fee.

The very first thing borrowers need to think about is what sort of product they want. One is a fixed-price amortizing mortgage, such as the frequent 30-12 months amortizing mortgage. The different is an adjustable rate mortgage where the speed can fluctuate over time. Once you’ve got made that alternative, then you’ll be able to take a look at any variety of websites that post mortgage rates to see which is the best match for your wants. Also, you need to bear in mind the posted notice fee, or the speed you locked in together with your lender that’s used to calculate your month-to-month principal and interest rate. Check that it does not embody any upfront fees or factors that might be charged.

![]()

Comparing rates and fees from several lenders is essential, not only from conventional lenders corresponding to local banks, but additionally Fintech lenders. Importantly, when evaluating provides, homebuyers have to take into account other costs past principal and interest payments. Shopping round is the important thing to landing the most effective mortgage price. Look for a price that’s equal to or beneath the common price for your loan term and product. Compare charges from no less than three, and ideally 4 or extra, lenders. This enables you to make sure you’re getting aggressive provides.

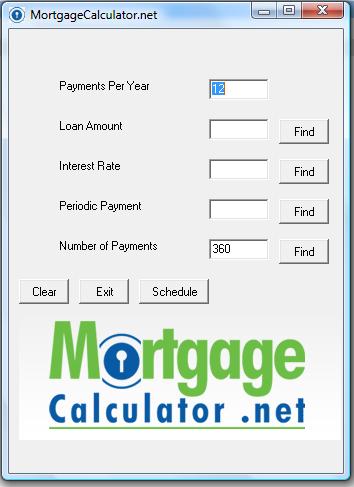

Other associated prices can embrace monthly charges, rates of interest, and more. Our mortgage comparability calculator helps put these factors into perspective so you’ll be able to choose the loan that’s best for you. For occasion, a lender might have advertised a low mortgage interest rate of 2.5%, however then charged $20 per month in account preserving charges and an annual $four hundred mortgage bundle payment. Once these expenses are added in, the loan might be costlier than a different financial institution that was charging 2.6%, however with no charges. APR is a tool used to check mortgage offers, even if they have different interest rates, fees and discount factors. APR takes ongoing prices like mortgage insurance under consideration, which is why it’s normally higher than the rate of interest.